Economics of nuclear power

By Dr. Nick Touran, Ph.D., P.E., 2020-01-26, Updated 2023-11-28, Reading time: 24 minutes

Generally, nuclear power plants (NPPs) are more expensive to build than conventional plants because of the required radiological protections. The process of converting mass to energy by splitting atoms involves the emission of radiation which must be shielded, often by several feet of concrete. Furthermore, the leftover atoms produced in any reactor (e.g. fission products and transuranics) radiate their excess energy quickly at first (requiring fail-safe cooling even after the chain reaction stops) and then slowly for many years (requiring careful nuclear waste handling and disposal).

On the plus side, nuclear fuel contains roughly 2,000,000x more energy per mass than any other form of fuel, providing many economic benefits:

- One fuel loading can last for 2 years, (whereas gas plants need continuous fuel supply via pipeline and coal plants need continuous supply via coal trains)

- Rock-bottom low lifecycle carbon emissions (12 gCO2-eq/kWh lifecycle)

- Very small waste footprint (whereas fossil fuel plants discharge their waste to the air, nuclear plants contain all their lifetime waste in dry casks).

- Very small land footprint

- Billion-year sustainability

Thus, nuclear plants have positive long-term attributes as energy systems, but they require significant up-front capital cost. Unfortunately, modern economic analysis methods today (involving the time value of money) weigh the early costs far higher than later costs, so front-loaded nuclear energy struggles.

This page is about the economic struggles of nuclear and what can be done to alleviate them so that it can continue to help out in the quest for long-term sustainable low-carbon energy.

Early days

After nuclear fission was discovered, humanity engaged in significant efforts around the

world to build economical power plants. This took about 20

years. Along the way, we experimented with dozens of different coolants, fuels, and

configurations. We tried liquid metal coolant, oil coolant, molten fuel, gas coolant,

nuclear superheat, sodium-graphite, sodium-deuterium, …, the whole nine yards. In

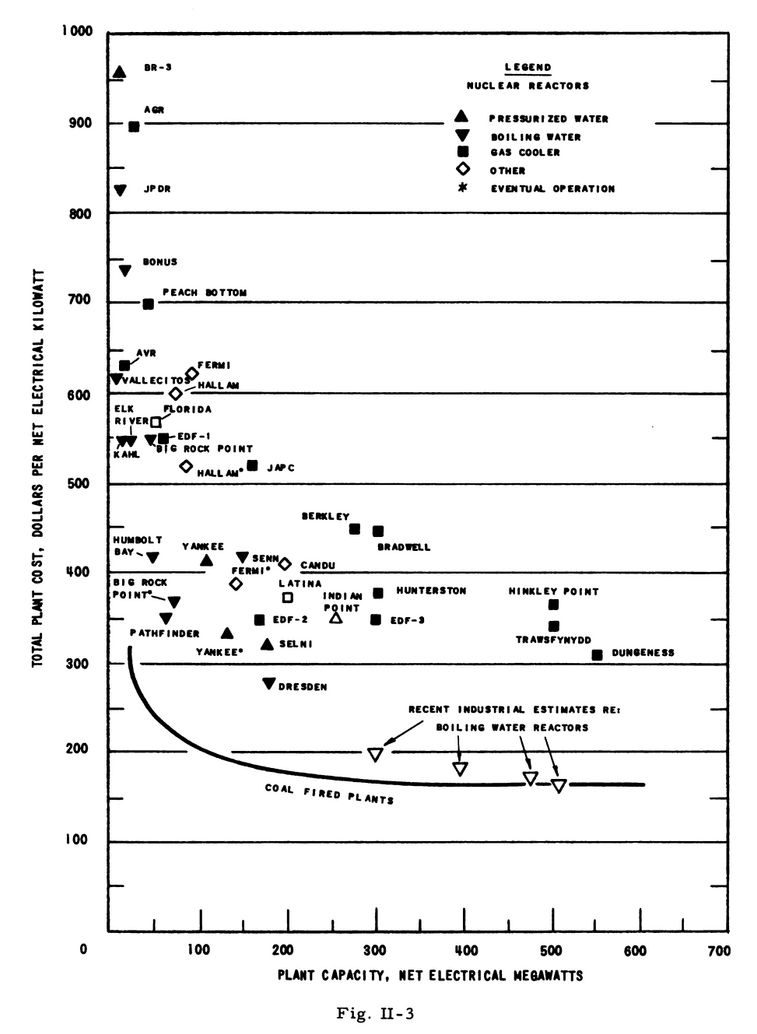

the late 1950s, GE and Westinghouse achieved considerable reliability with medium-sized

light-water reactors and realized that by capturing economies of scale, they could find economical

power. By 1965, large-scale power plants were being sold commercially at costs competitive

with fossil fuel plants. Electricity use in the USA was growing at 7%/year and over 100

reactors were ordered to meet the demand.

After nuclear fission was discovered, humanity engaged in significant efforts around the

world to build economical power plants. This took about 20

years. Along the way, we experimented with dozens of different coolants, fuels, and

configurations. We tried liquid metal coolant, oil coolant, molten fuel, gas coolant,

nuclear superheat, sodium-graphite, sodium-deuterium, …, the whole nine yards. In

the late 1950s, GE and Westinghouse achieved considerable reliability with medium-sized

light-water reactors and realized that by capturing economies of scale, they could find economical

power. By 1965, large-scale power plants were being sold commercially at costs competitive

with fossil fuel plants. Electricity use in the USA was growing at 7%/year and over 100

reactors were ordered to meet the demand.

Costs rise and demand slows in the 1970s

The 1970s brought high construction interest rates, increasing operating experience, and sharply slowing electricity demand. Because externalities and public proximity rise with fleet size, Komanoff suggested that the strongest driver in costs of any power plant system is the size of the fleet2.

Retrofits

Early reactors built did not have the benefit of operating experience informing their designs. As the fleet grew and encountered various events, safety and operational retrofits were added to the fleet. The retrofits included the following1:

- After the 1975 Browns Ferry fire, more redundancy in safety-related instrumentation/control cables was required, and they needed 3-hour firewalls be installed between them.

- The BWR Mark I containment was reinforced

- BWR recirculation pipes were repaired after the discovery of intergranular corrosion cracking

- PWR steam generators required repair

- Pipes and other components needed reinforcement via the NRC Standard Review Plan

- Retrofits related to the Three Mile Island (TMI) accident

On average, these retrofits increased capital costs by about 28%. Counter to common sentiments, the majority of these costs were not from TMI. Only 12% of retrofit costs were related to TMI, with 50% from other regulatory drivers and 38% from utility initiated operations-improving purposes1.

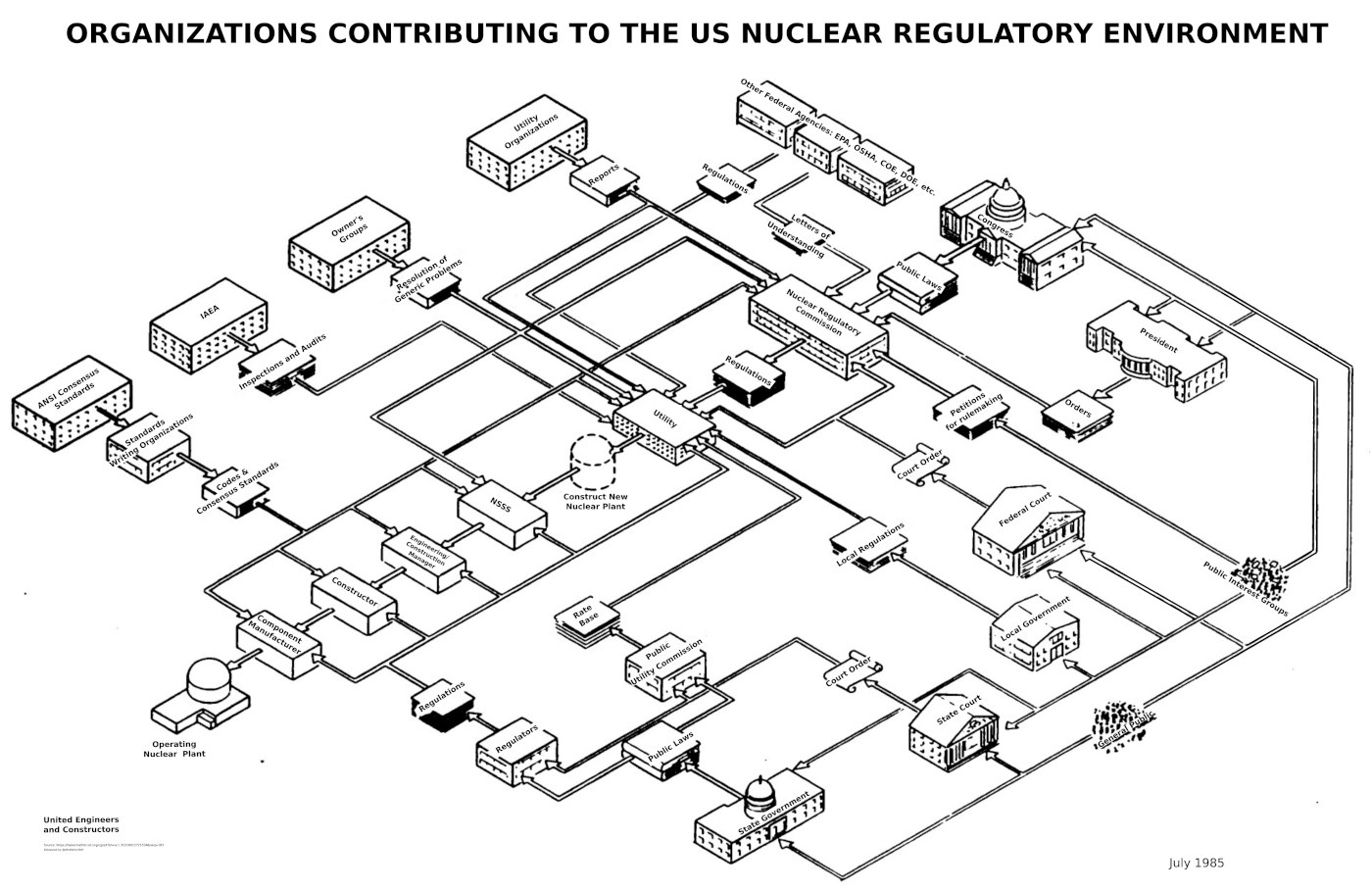

Public concern grows, and so do regulatory guides and costs

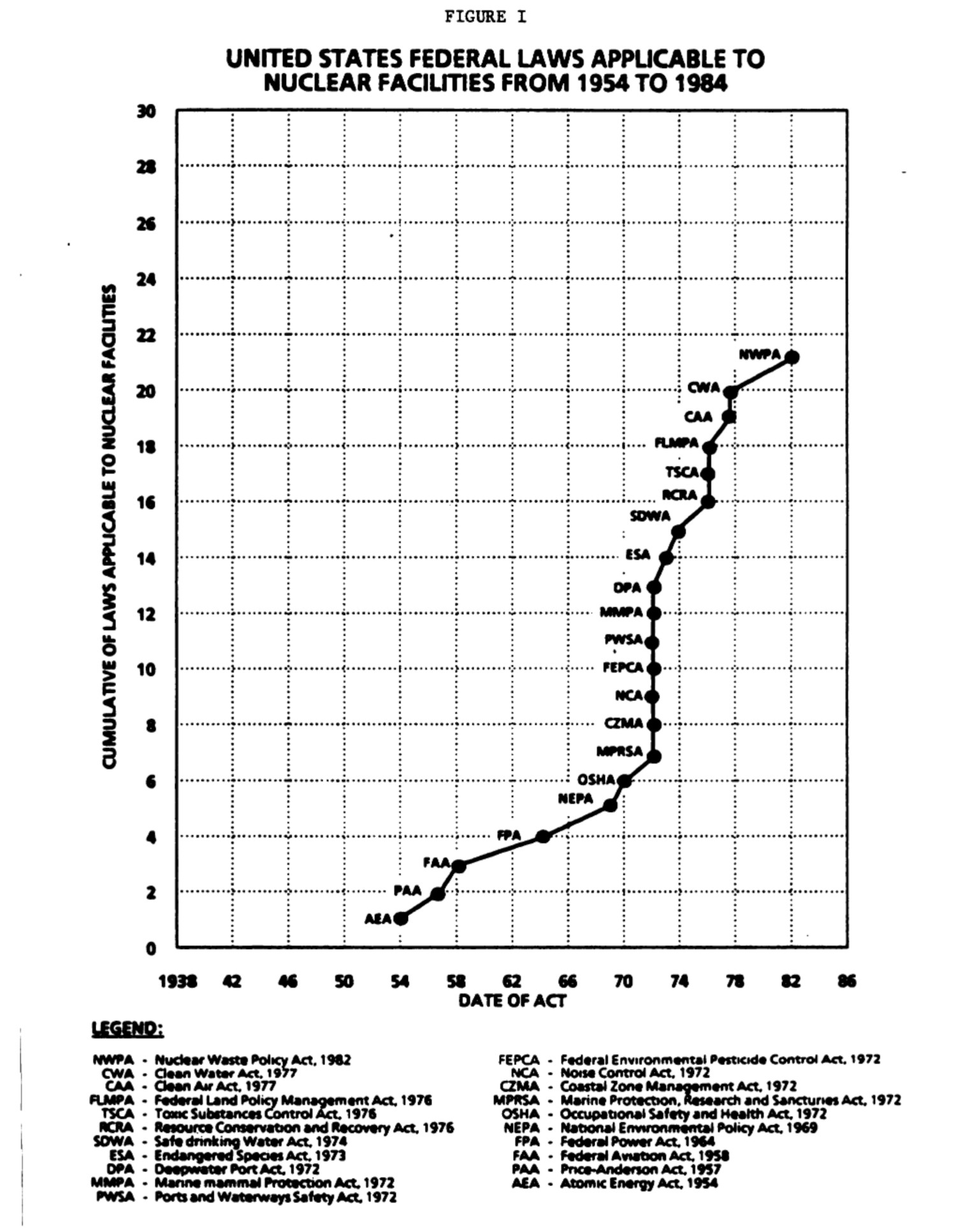

As NPPs became better understood, larger, and more common, regulations on their licensing, construction, and operation became more stringent.

Other effects of growth and experience included1:

- The number of engineering standards applied to nuclear equipment rose from 400 in 1970 to 1800 in 1978.

- The number of NRC guides and positions increased from 4 in 1970 to 304 in 1978.

- Quantities of concrete, steel, cable, cable tray, and conduits needed in a plant all basically doubled between 1973 and 1978 to protect from internal missiles, pipe whip, and seismic events.

- Improved quality assurance (QA) programs were instated requiring careful inspection, qualification, and monitoring of safety-related equipment. Between 1967 and 1980, per-kilowatt engineering labor increased 9-fold and craft labor increased 5-fold.

- Construction times rose from 5.5 years to 12

- Inflation escalated the costs of commodities

- Interest rates grew from less than 8%/year to up to 14%/year.

Contract terms with construction companies became cost plus arrangements, which were poorly aligned with project success. Contractors maximized revenue with poor labor productivity.

Where small modifications to cable installations would typically be field corrected, nuclear construction required that a change be sent back to the engineer, added to the drawings, tagged, reviewed, and inspected. Paperwork obsoleted on the job site often lost important notes. All impact wrenches had to have their automatic cutoffs calibrated twice daily. Costs spiraled out of control.

Some more examples of changes include2:

- Triaxial accelerometers and spectrum recorders were added to much equipment, piping, and containment.

- Reg Guide 1.117 required protection from 360 mph tornado winds, in some cases increasing building wall thickness from 18 inches to 24.

- Drain systems for firefighting waterflow had to both prevent fire from spreading and also sample water for radiation.

- Swing diesels at multiunit plants were prohibited by RG 1.81.

- Liquid radwaste had to be solidified before shipping with cement systems costing $20/kW.

- Anti-sabotage measures attempted to avoid any one person in the maintenance crew from working on a set of redundant equipment

By the mid-1970s, NPP cancellations were rolling in due to the unexpected complexities and costs. The half-finished Marble Hill NPP was cancelled. 4 out of the 5 WPPS reactors were cancelled. Today, half-built old NPPs are still found in many parts of the USA.

Coal plant costs rose too

In the 1970s, coal plants also suffered cost escalation due to growing fleet size. Public concern over deadly air pollution led to regulations such as the Clean Air Act which required the addition of scrubbers, adding 26% to coal capital costs2. Later concerns about acid rain added more.

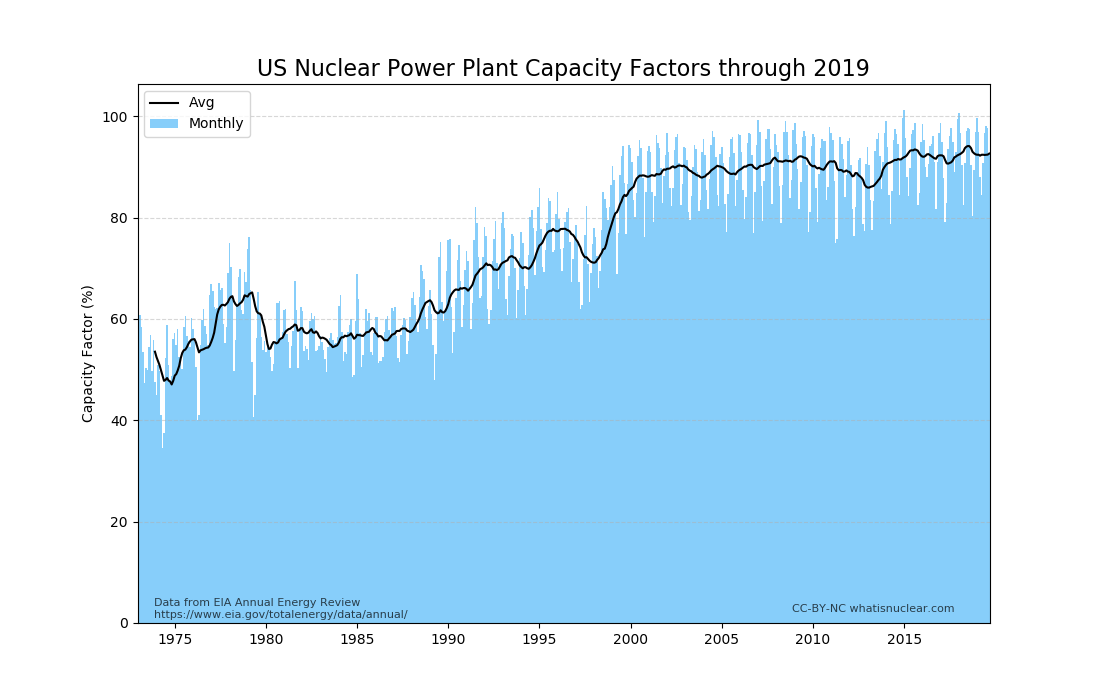

The astounding rise of capacity factor

All those improvements in quality and redundancy did cost a lot to install, but they arguably had a massive payback in terms of operating efficiency.

In 1985, the capacity factor (the fraction of the time the plant is producing its full rated capacity) of most plants was in the 50%–60% range, with only a few reaching into the 70s. Issues with pipe cracking, water chemistry, steam generators, turbines, generators, and refueling all led to downtime. Many analysts in the 1980s predicted that NPP capacity factors would never exceed 60%–65%1,2. However, between 1985 and 2000, the US fleet average capacity factor rose astoundingly from under 60% to well above 90%3.

With the plants producing power more of the time, electricity sales revenue went up proportionally, and the economic challenges of the 1970s were effectively licked, even with the more stringent regulatory regime. Still, events like TMI, the acceleration of anti-nuclear sentiment and pop-culture, and the unexpected reduction in energy demand flattened out the nuclear growth curve.

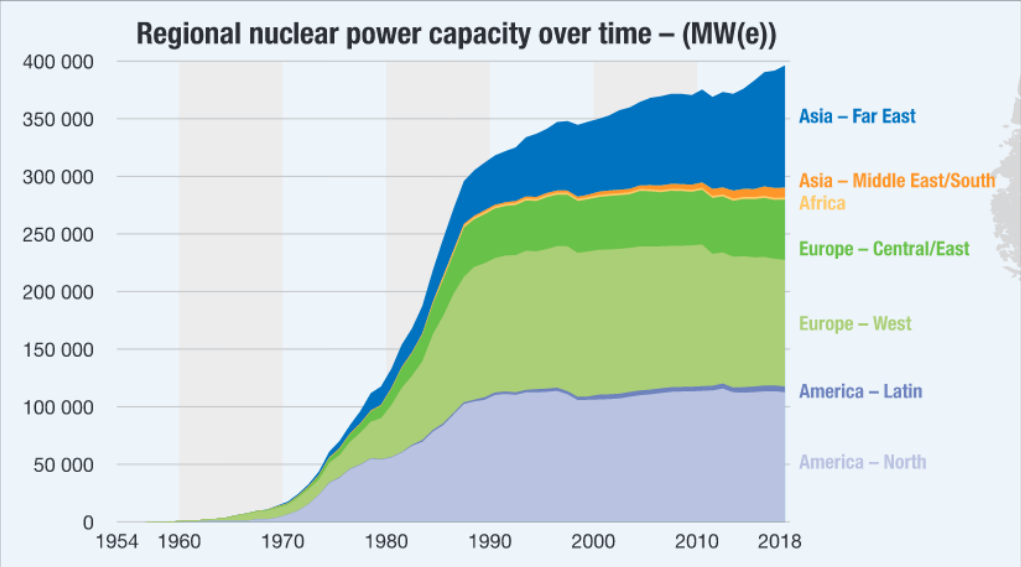

Outside the US, many countries took a focused single-design focused approach. France chose the PWR and produced them in serial. South Korea did similar. Japan largely chose BWRs. Construction trends in these countries is described in detail in Lovering, 20169. The Korean approach of choosing one design, optimizing the heck out of it, and building lots of them is described lucidly by KunMo Chung in this enlightening Titans of Nuclear podcast episode.

Nuclear renaissance?

Starting around 2003, phenomenal NPP operation and capacity factors combined with growing concerns about climate change and volatile fossil fuel prices to spur what we all called a Nuclear Renaissance. We expected new builds to start happening again in the USA, largely featuring new, simplified, and safer reactors like the AP1000 and ABWR. These reactors were designed with the modern nuclear regulatory regimes in mind and featured major reductions in complexity by focusing on natural safety systems. At the same time, concerns over climate change were becoming more serious and widespread. With nuclear being very nearly carbon-free, nuclear enrollments soared at universities.

The current situation

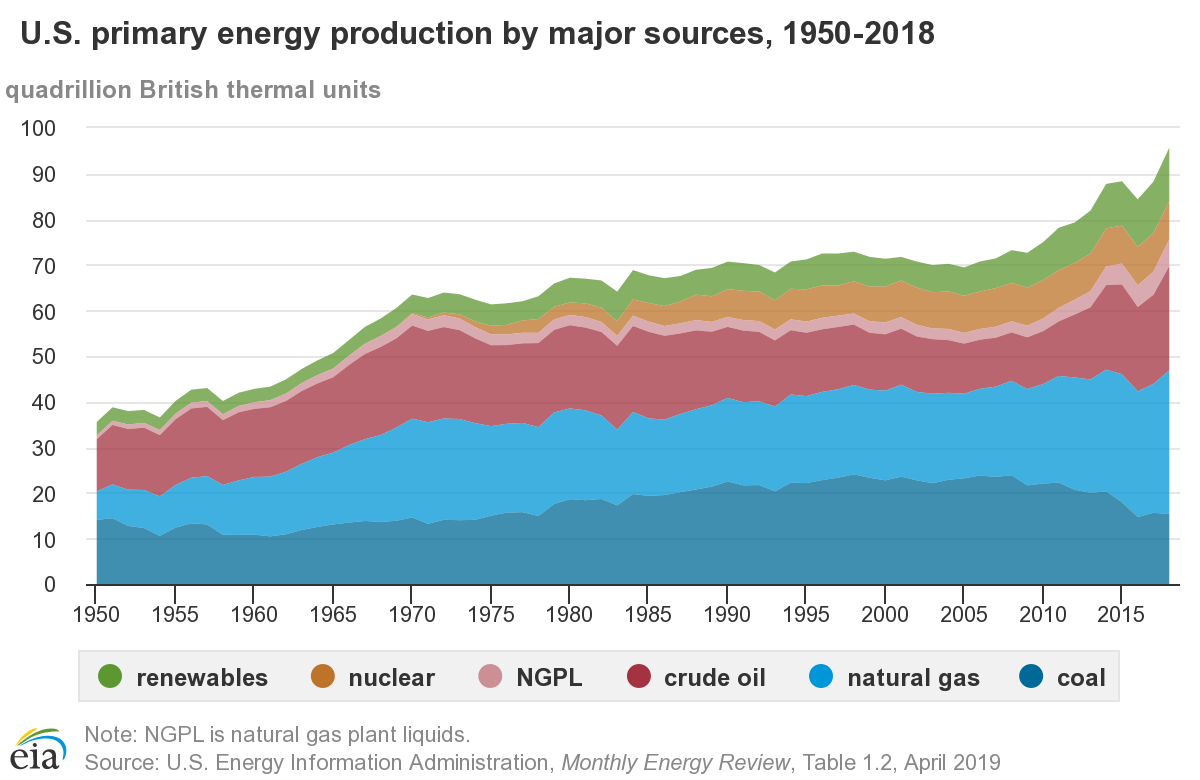

As of 2020, the peaceful atom now churns away in 450 commercial nuclear power plants around the world, generating nearly 400 gigawatts of clean-air electricity without carbon emissions. But it has not replaced fossil fuel worldwide, which remains above 80% of the world’s primary energy. Indeed in many parts of the world fossil fuel is replacing it. The direct reason for this is economics: it is often more expensive to prop up and operate a nuclear industry than it is to build a fracked natural gas turbine or coal plant.

Existing plants challenged by cheap fracked natural gas

In the USA, fracking and horizontal drilling have opened up vast new resources of natural gas, which is better than coal from an air pollution point of view, but about as bad from a carbon-emissions point of view (when you factor in well and pipeline leaks). Additionally, natural gas turbines are highly efficient, finely tuned machines. A large unit can be built for $1B in a few years and operated by a small crew. They ramp up and down in power readily. As a result, electricity prices in deregulated markets have fallen. As portable liquefied natural gas (LNG) export ports activate in the Gulf of Mexico, cheap American fracked gas is now influencing the world energy markets.

Nuclear plants do not benefit from the new access to cheap fracked fuel and experience this as a reduction in electricity sales revenue. Thus, the nuclear industry must reduce its operating costs to survive.

The NEI published many results from their Delivering the Nuclear Promise effort, attempting to pinpoint the highest-impact efficiency gains for the operating fleet. This included a list of Efficiency Bulletins that go into some detail about a few dozen key operational inefficiencies that can be improved upon.

Meanwhile, clean energy mandates are varied in whether or not they include nuclear energy. The environmentalist movement itself dates back to opposition against atmospheric nuclear weapons testing, and nuclear power plants have long been associated with them (an association not helped by accidents at Three Mile Island, Chernobyl, and Fukushima).

But the low-carbon nature of nuclear power is clear and undisputed, and the actual data comparing the health effects of fossil fuels (~6 million deaths/year) to nuclear (up to 4000 deaths ever) is hard to ignore. The ensuing debate here reaches well beyond science and into personal identity itself. Progress is being made as this identity issue is being recognized by climate-inspired advocates of nuclear energy.

New builds

Recent new construction of nuclear plants in the west has been fraught with boondoggle. The troubles with the Westinghouse AP1000 have been the most distressing to me personally, since the design was to be the conquering hero of the Nuclear Renaissance I was so excited about in nuclear engineering undergrad back in the mid-2000s. The July 2017 cancellation of the two AP1000s at VC Summer, the astronomical delays and overruns at Plant Vogtle, and the bankruptcy of Westinghouse were all devastating.

Late-stage regulatory-enforced re-design of the aircraft impact shield building for AP1000s caused part of the delay, but a Bechtel report released by the South Carolina Governor’s office highlights lack of experience, contract misalignment, and lack of detailed engineering design.

Elsewhere, the EPR builds in Finland (Olkiluoto 3), France (Flamanville 3), and the UK (Hinkley Point C) are all many years late and many billions of Euros overbudget.

In China, the Taishan EPRs fared better and entered commercial operation in 2018 and 2019. In fact, 9 new gigawatt-class PWRs entered commercial operation in 2018, all in Russia and China. The Russians, South Koreans, and (before Fukushima) Japanese have effectively perfected their standardized large LWR designs and can deliver them in reasonable times and budgets. China now has experience building a wide variety of different reactor models.

Improving modern nuclear power economics

Many attempts to reduce costs of nuclear power have continued through the years and are ongoing today.

The OECD/NEA capital cost study

Though it was more than 20 years ago, the OECD/NEA got together and a group of nuclear experts from 14 nations to discuss their experiences and find ways to improve. The findings were published in a report: Reduction of Capital Costs of Nuclear Power Plants. The experts concluded that the following will help nuclear economics:

- Increase plant size to capture economies of scale. Canada found that 2x 881 MWe CANDUs were 75% the cost of 1x 670 MWe unit. France cut costs by more than 2x by scaling from 300 MWe to 1350 MWe. The US provided data suggesting a 35% reduction in cost going from 600 MWe to 1300.

- Standardization and construction in series — This was found to have large potential for capital cost reduction: between 15% and 40%. Building in series avoids continued first-of-a-kind (FOAK) efforts and increases productivity. FOAK costs include functional studies, technical specifications, general layout, detailed design of civil structures, buildings, equipment, piping, and cabling, drawing up test/commissioning procedures, operating documents, safety studies, and equipment qualification.

- Multiple unit construction — By sharing siting, licensing costs, site labour, and common facilities, up to 15% capital cost reduction can be achieved.

- Improved construction methods were expected to make modest improvements, more so to construction schedule than overnight cost. In particular, open-top access reduced construction duration by 15% in Canada. Modularization reduced costs by 1.4–4%. Slip-forming techniques can lead to 5% reduction in schedule. Appropriate sequencing of contractors can cut total cost by 6–8%.

- Design Improvement — Design takes up about 10% of the total capital costs of a NPP. Improving quality and efficiency of the design process can help. Additionally, design that optimize plant arrangements, accessibility, and simplification were expected to be impactful. Successes in the ABWR, AP600 (which was later uprated to AP1000 due to economies of scale), System 80+, etc. were listed as evolved designs.

- Improved procurements, organizational, and contractual arranagements — Turnkey arrangements vs. Multiple Package Contract vs Split Package Contract approaches were compared. No meaningful preference was found.

The MIT Future of Nuclear report

In 2018, MIT issued a report entitled The Future of Nuclear Energy in a Carbon-Constrained World. The study highlighted the fact that nuclear still only provided 5% of the global world energy. It studied modern trends and concluded that US and European new builds demonstrate repeated failure of construction management. They recommended:

- Complete detailed design prior to construction

- Use proven supply chain and skilled workforce

- Incorporate manufacturers and builders into design teams early

- Appoint single primary contract manager with experience

- Establish contract structure that aligns all actors with project success

- Enable a flexible regulatory environment that can accommodate small unanticipated changes in design and construction quickly.

- Do more serial manufacturing of standardized plants

- Shift to reactor designs with inherent and passive safety features

- Use policy to level the playing field for all low-carbon generation technologies (e.g. incorporate CO2 into the cost of energy)

- Governments should establish reactor sites where companies can deploy prototypes

- Governments should fund prototype testing and commercial deployment via licensing cost share, R&D cost share, technology milestone funding, and production credits for successful demonstration of new designs

ETI Nuclear Cost Driver report

In April 2018, ETI published a report about the cost drivers of nuclear projects (here’s the press release). The key findings from their research and analysis reached the following findings for cost-effective nuclear:

- Complete design before construction

- Use best contracting practices

- Develop multiple units at a single site

- Innovate to improve alignment with labor

- Tie government support to successful application of cost reduction measures

- Incentivise learning

- Seek government financing

- Transform regulations to focus on cost-effective safety

Some of these findings are starting to sound familiar!

Advanced reactor designs

Regarding advanced designs like molten salt reactors, sodium-cooled fast reactors, gas-cooled reactors, and so on, MIT found that they may struggle to compete with mature LWR designs. Furthermore, they suggested that most cost reductions can be done regardless of the particularities of the core and fuel cycle.

Still, the potential simplicity allowed by truly passive safety systems is intriguing. The allure of “rebranding” nuclear with new designs touting superior performance is also strong, and has played a role in a wave of private investment in small advanced nuclear companies. This kind of investment is very exciting and powerful. It must take care, however, to avoid simply repeating history with previous advanced reactor efforts. Success in new reactor development is so much more than restarting new reactor development. Innovative approaches that are resilient to “unexpected” technical challenges and long equipment qualification processes are called for. Of course, restarting the work is an essential prerequisite to success.

Michael Shellenberger has argued that advanced reactors have always been more expensive to build and operate due to their complexities and lack of supply chain. He suggests we build as many standardized LWRs as possible to decarbonize with what we know ASAP, and then use the profits from that success to develop longer-term reactors (like breeders). The debate here is an old one: is it possible to make large-scale economic nuclear power with LWRs, or do we need to push new designs to have a chance? Shellenberger argues that due to experiences in Korea and France, we know for a fact that LWRs can decarbonize at massive scale and so we should just do that now rather than hoping for success in highly-uncertain advanced reactor development projects.

A middle-ground approach was that promoted by Alvin Weinberg later in his life. In his 1985 paper The Second Nuclear Era, he promoted PIUS PWR, where a boron density lock is arranged above the core in a pre-stressed concrete reactor vessel. There are no control rods. It is exceedingly difficult to postulate any event, including sabotage, that can challenge the reactor. In a post-Chernobyl world, the simplicity and safety of PIUS may be what the world demands.

Small reactors: economies of scale vs. economies of mass production

The distressing boondoggle large LWR builds in the West have pushed the nuclear industry towards a promotion of small modular reactors (SMRs). Being smaller, these technologies are easier to develop, cheaper to build (in absolute dollars, not dollars/kW), and less taxing from a safety point of view. It is hypothesized that factory production will enable Henry Ford-esque assembly line production efficiencies for large numbers of small, rail-shippable plant components. Of course, this is a major departure from past wisdom and successes showing that bigger is cheaper.

I can’t help but think of the economic non-starter military microreactors of the Army Nuclear Power Program, which were quoted back then as being 10x too expensive, even with wartime oil prices to compete with. And the early LWRs, which necessarily had to scale up to compete.

On the other hand, starting with small reactors, shaking them down in fringe high-cost markets, innovating relatively rapidly with multiple units while bootstrapping new equipment, regulation guides, and suppliers is the only way new reactors have been developed in the past. If someone can achieve economies of mass production that meet and then exceed economies of scale with a small reactor along the way, then that’s a great bonus.

Economies of scale AND economies of mass production?

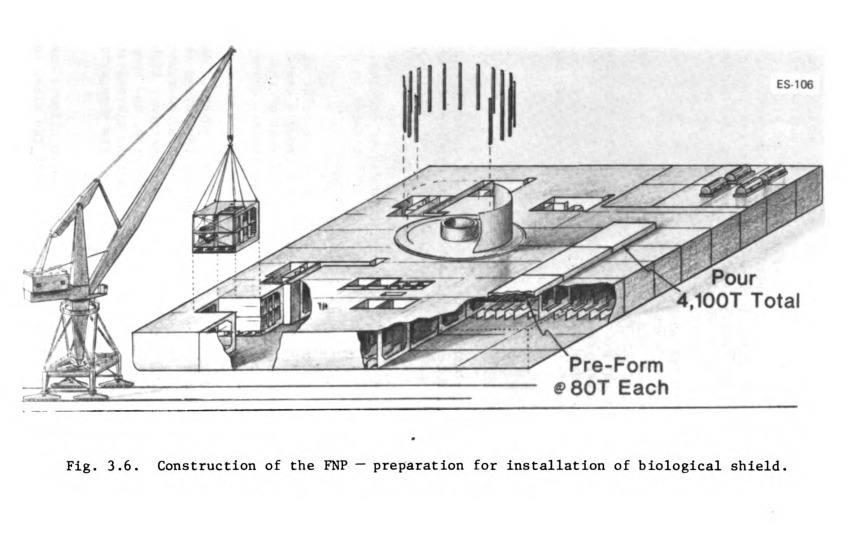

One has to wonder, is there a way to achieve economies of scale and economies of mass production at the same time? Around 1970, Westinghouse asked this question, and also tried to deal with the ever-present NIMBY effect near new power plants at the same time. They came up with a fascinating project to achieve it. They were struggling to find appropriate sites along the Atlantic coast, but utilities had significant energy demand from oil refineries.

They came up with the idea of building a gigantic production yard near the sea and using it to produce 4 large LWRs on huge floating platforms every year. The floating NPPs would be delivered by sea and be installed within 3 miles of the shore in an artificial lagoon made of giant concrete cruciform jacks. They formed a joint venture with Newport News called Offshore Power Systems, bought half of Blount Island in Jacksonville, FL, hired 1000 people, and started building the site and preparing the design and regulatory documents.

Update: There’s now a full page on OPS.

This sounds crazy at first, but on second glance it actually is an incredible idea. From a safety point of view, you decouple from earthquakes and design to handle hurricanes and ship collisions. The biggest safety concern in a LWR is losing cooling water, but at sea there is infinite water. Plus in the absolute worst case, there are very few people around who can be injured by a black-swan event (meteorite, etc.). From a cost perspective, it hits all the marks: standard design, experienced construction crew, factory production, controlled construction environment.

The NRC did significant safety analysis of these systems and the safety was looking fine.

So what happened? The 1973 oil shocks killed demand off the New Jersey coast. OPS delayed for a few years and ended up kicking the bucket, not because it was a bad idea, but because it was the wrong time.4

If you want to see what rapid decarbonization at scale could look like, look no further than OPS.

At the moment, Russia and China are working on Floating NPPs for fringe energy purposes. The Akademik Lomonosov began operations in December, 2019.

Conclusions

- Nuclear reactors were really expensive at first

- From 1947-1965 a bunch of teams built dozens of crazy reactors competing to make one of them cheap

- In 1965, large LWRs (pressurized and boiling) broke through and got cheap

- Throughout the 1970s, operating experience made LWRs more expensive

- Most of the cost increases were due to specific fairly serious incidents

- Costs were rising rapidly well before TMI

- The maturing industry and design delivered stellar operating performance and survived and thrived well into the 2000s

- Fracked natural gas came along and screwed up the economics even though it is high carbon

- If markets valued the low-CO2 nature of nuclear, they’d be doing better

- Multiple hypothetical approaches to reduce nuclear costs are ongoing. No one knows for sure if any of them will work, or which one will work best

- Factory-produced large reactors on floating platforms is a surprisingly intriguing idea to make reactors cheap

2019 saw some pretty impressive accomplishments in nuclear. If we find and deliver on good ways to cut costs while improving safety, nuclear technology will have a larger role to play in decarbonizing our energy systems.

References

- Phung, “Economics of Nuclear Power: Past Record, Present Trends, and Future Prospects”, Energy, 10, 8 (1985). doi:10.1016/0360-5442(85)90004-0

- Komanoff, Charles. Power plant cost escalation: nuclear and coal capital costs, regulation, and economics. Vol. 12. Van Nostrand Reinhold Company, 1981. (Full book freely available from the author)

- Nuclear Power Annual Review, US EIA EIA

- Rod Adams, Offshore Power Systems: Big Plants for a Big Customer

- OECD, Reduction of Capital Costs of Nuclear Power Plants (2000)

- Komanoff, 10 blows that stopped nuclear power (1991)

- MIT, The Future of Nuclear Energy in a Carbon-Constrained World, 2018

- ETI Nuclear Cost Drivers Project Summary Report

- Lovering, Historical construction costs of global nuclear power reactors, Energy Policy, 91, (2016) doi:10.1016/j.enpol.2016.01.011

- DOE/NE-0009 Power Plant Capital Investment Cost Estimates: Current Trends and Sensitivity to Economic Parameters (1980)

See Also

- Testimony of John Crowley, Nuclear Powerplant Standardization, 1985

- Phung, Theory and evidence for using the economy-of-scale law in power plant economics, 1987 ORNL/TM-10195